Recognizing Livestock Threat Security (LRP) Insurance Coverage: A Comprehensive Overview

Navigating the world of livestock threat security (LRP) insurance can be a complex undertaking for lots of in the agricultural market. This sort of insurance policy supplies a safeguard versus market variations and unanticipated conditions that could influence livestock manufacturers. By understanding the ins and outs of LRP insurance policy, producers can make educated choices that may secure their procedures from financial dangers. From just how LRP insurance works to the numerous coverage choices offered, there is much to discover in this detailed guide that could possibly form the means animals producers approach threat administration in their businesses.

Exactly How LRP Insurance Works

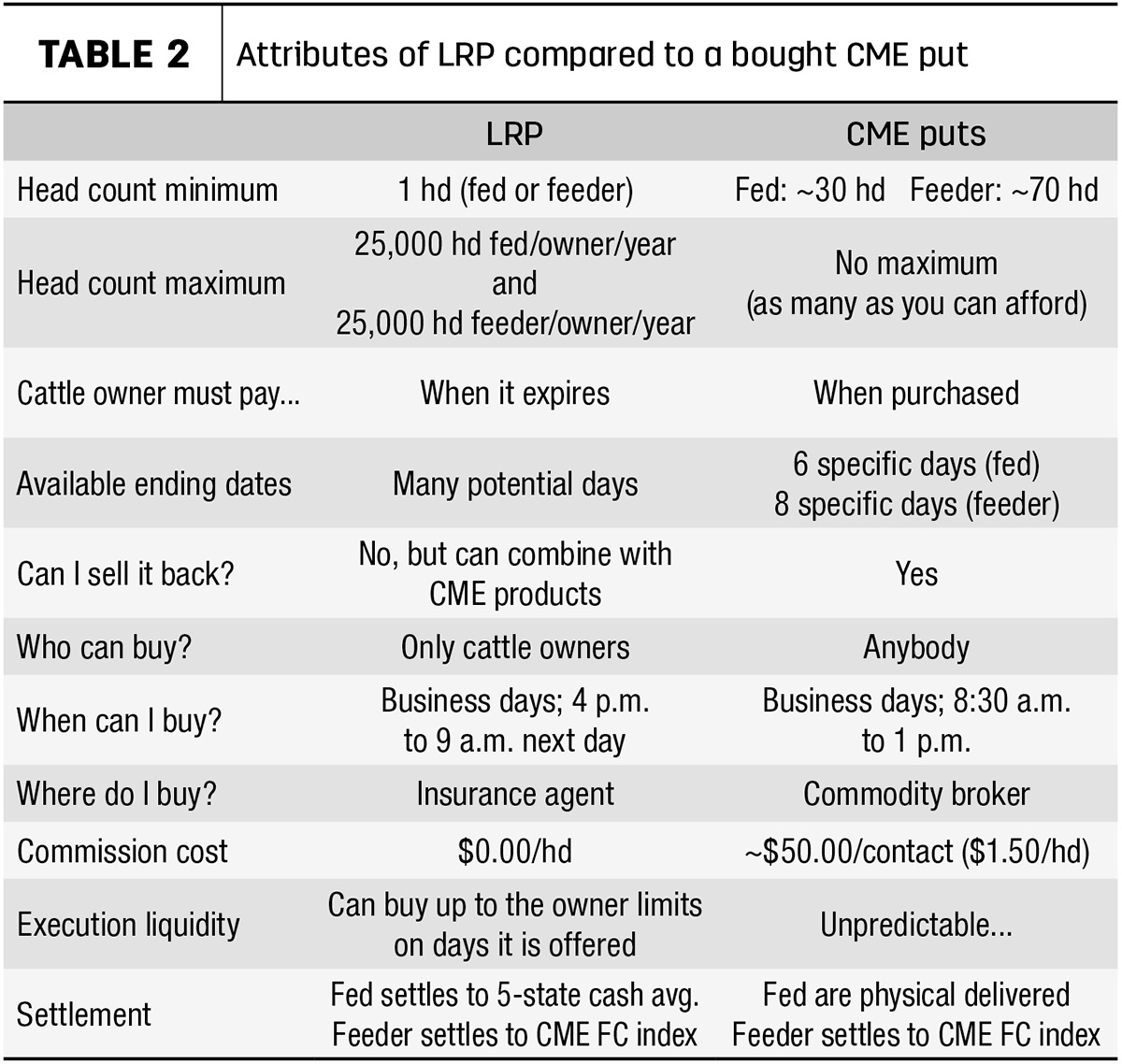

Sometimes, recognizing the auto mechanics of Animals Threat Defense (LRP) insurance policy can be complicated, but damaging down exactly how it works can supply clarity for herdsmans and farmers. LRP insurance policy is a danger monitoring device created to secure livestock manufacturers against unanticipated cost declines. The policy enables producers to set a coverage level based upon their particular needs, picking the number of head, weight array, and insurance coverage price. As soon as the policy remains in place, if market value fall listed below the coverage cost, manufacturers can sue for the difference. It is necessary to keep in mind that LRP insurance is not a revenue warranty; instead, it focuses only on cost danger protection. The coverage duration usually ranges from 13 to 52 weeks, offering adaptability for manufacturers to pick a duration that lines up with their manufacturing cycle. By utilizing LRP insurance coverage, ranchers and farmers can reduce the economic threats related to changing market value, guaranteeing higher security in their procedures.

Eligibility and Insurance Coverage Options

When it concerns coverage options, LRP insurance supplies producers the adaptability to pick the protection degree, protection period, and recommendations that ideal match their threat monitoring demands. Coverage levels commonly range from 70% to 100% of the expected ending value of the insured livestock. Producers can likewise pick insurance coverage durations that align with their production cycle, whether they are insuring feeder cattle, fed cattle, swine, or lamb. Endorsements such as price risk security can additionally tailor insurance coverage to shield against negative market variations. By recognizing the qualification standards and insurance coverage alternatives readily available, animals producers can make informed decisions to manage risk efficiently.

Advantages And Disadvantages of LRP Insurance Policy

When evaluating Animals Threat Security (LRP) insurance policy, it is essential for animals producers to weigh the benefits and downsides inherent in this danger management device.

One of the key advantages of LRP insurance policy is its ability to supply protection versus a decline in animals prices. This can aid guard manufacturers from financial look at these guys losses resulting from market variations. Furthermore, LRP insurance offers a level of versatility, enabling producers to tailor protection degrees and policy periods to suit their specific requirements. By securing in an ensured rate for their animals, manufacturers can much better manage risk and prepare for the future.

One restriction of LRP insurance is that it does not protect versus all kinds of threats, such as disease episodes or natural calamities. It is vital for producers to thoroughly analyze their private threat direct exposure and economic situation to determine if LRP insurance coverage is the best risk management device for their procedure.

Comprehending LRP Insurance Premiums

Tips for Maximizing LRP Perks

Making best use of the benefits of Animals Threat Protection (LRP) insurance coverage needs strategic planning and proactive threat you could try these out monitoring - Bagley Risk Management. To take advantage of your LRP coverage, consider the complying with ideas:

Regularly Assess Market Conditions: Stay informed about market trends and rate changes in the animals industry. By checking these variables, you can make informed decisions about when to purchase LRP coverage to secure versus prospective losses.

Set Realistic Coverage Levels: When picking insurance coverage degrees, consider your manufacturing costs, market worth of animals, and potential dangers - Bagley Risk Management. Establishing sensible insurance coverage levels guarantees that you are effectively shielded without paying too much for unneeded insurance policy

Diversify Your Bonuses Protection: Instead of counting entirely on LRP insurance policy, consider diversifying your danger management approaches. Integrating LRP with various other risk management tools such as futures contracts or choices can supply detailed coverage versus market uncertainties.

Evaluation and Change Coverage Regularly: As market problems transform, periodically review your LRP coverage to guarantee it lines up with your current threat direct exposure. Adjusting protection levels and timing of acquisitions can aid enhance your danger defense method. By following these pointers, you can make the most of the advantages of LRP insurance coverage and safeguard your livestock procedure versus unexpected threats.

Conclusion

Finally, livestock danger defense (LRP) insurance is a useful device for farmers to manage the economic threats related to their livestock operations. By recognizing how LRP works, qualification and coverage options, in addition to the pros and disadvantages of this insurance, farmers can make informed choices to shield their incomes. By very carefully considering LRP premiums and carrying out strategies to maximize advantages, farmers can alleviate potential losses and make certain the sustainability of their procedures.

Animals manufacturers interested in getting Livestock Risk Defense (LRP) insurance coverage can explore a variety of qualification criteria and protection options tailored to their particular livestock procedures.When it comes to coverage alternatives, LRP insurance supplies manufacturers the adaptability to pick the insurance coverage level, protection period, and endorsements that finest fit their danger management requirements.To comprehend the intricacies of Livestock Danger Protection (LRP) insurance coverage completely, understanding the variables influencing LRP insurance policy premiums is important. LRP insurance costs are determined by various components, consisting of the insurance coverage degree chosen, the expected rate of animals at the end of the coverage duration, the type of livestock being guaranteed, and the size of the protection period.Review and Adjust Insurance Coverage Consistently: As market problems transform, regularly evaluate your LRP insurance coverage to ensure it straightens with your present risk direct exposure.